You can use our 15 year calculator to see how much you would need to pay each month to extinguish your loan in 15 years & then try to regularly pay that amount to pay your loan off faster. But if you have a 30-year fixed mortgage, you can still shorten your payment term by paying extra. Lenders also require higher credit scores for shorter terms that increase your monthly debt service expenses. You pay more interest & higher interest rates with a longer loan term than a shorter one.įifteen-year fixed-rate loans come with higher monthly payments, which can easily turn off homebuyers who are looking for more affordable monthly payment.

#State farm mortgage calculator extra payment mac

Freddie Mac publishes a graph showing the historical spread in their PMMS survey results. However, 30-year fixed mortgages usually come with 0.25 to 1 percent higher rates compared to 15-year fixed-rate loans. Its popularity is due to low monthly payments and upfront costs. As of June 2020, the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. Most homebuyers in America tend to obtain 30-year fixed-rate mortgages. We’ll also talk about its disadvantages and other precautions you should take before making additional loan payments. Then, we’ll discuss different payment strategies you can take to maximize your extra payments. Our guide below will talk about the benefits of making additional mortgage payments and how they work. The added payments can cut years off your term and save thousands of dollars in interest costs. This is advantageous if you have an extended loan, such as a 30-year mortgage. If you want to reduce interest costs, you must budget for extra mortgage payments. Once you get keys to your home, you must keep planning your finances.

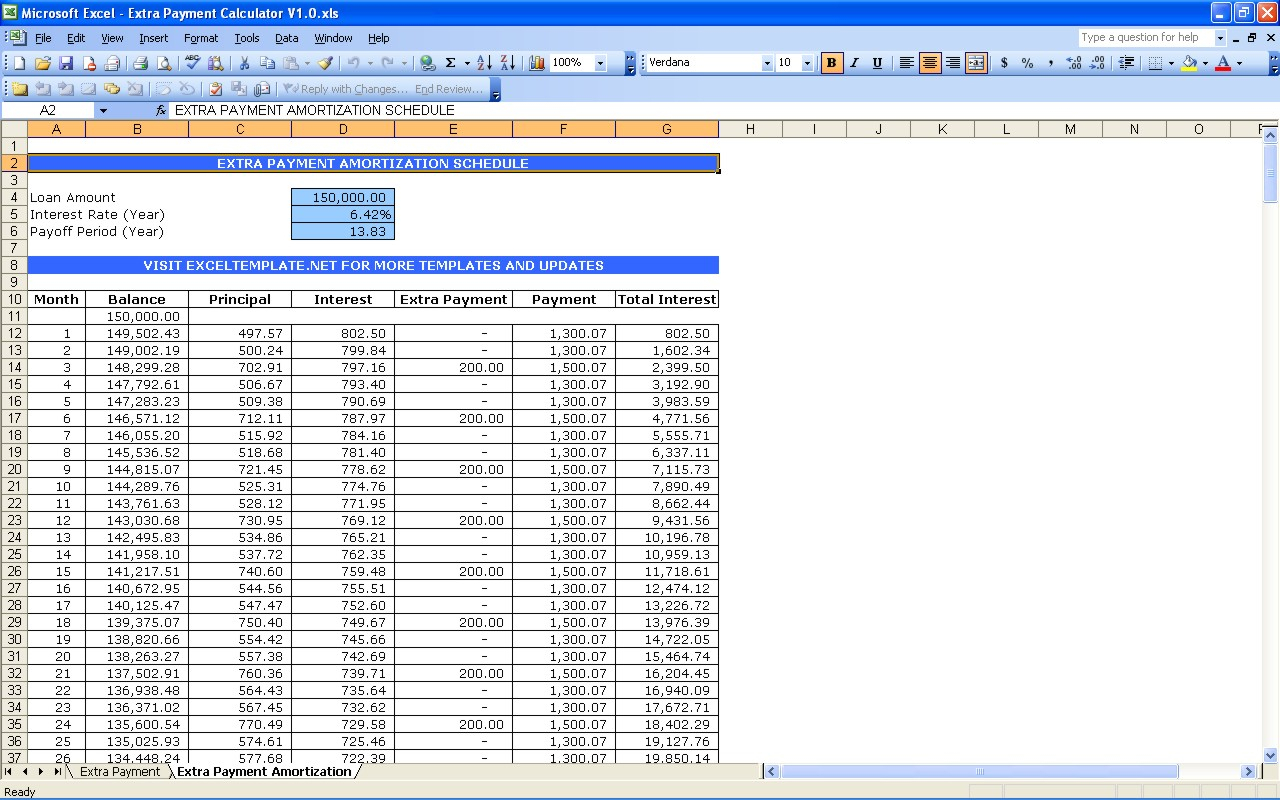

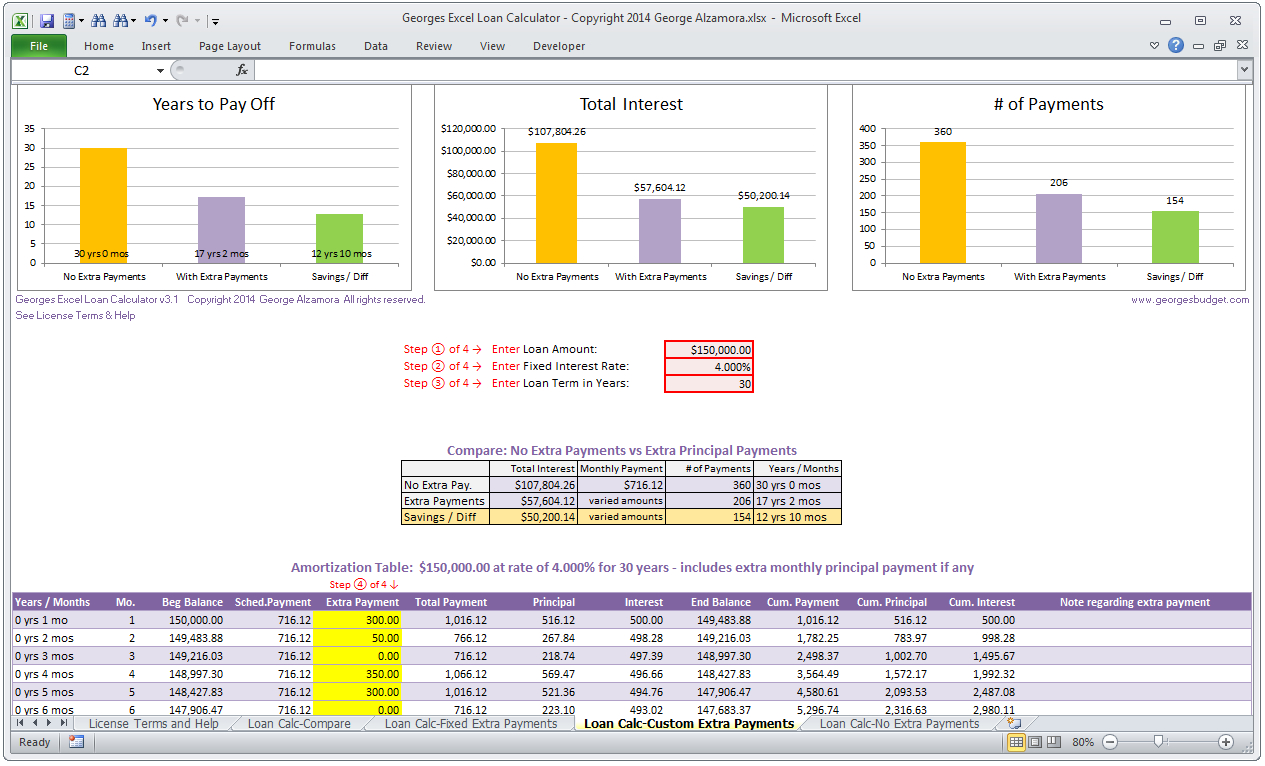

And once you sign the deal, you must budget for monthly mortgage payments. On top of this, you must shop for the lowest mortgage rate to save on interest charges. It requires careful financial preparation, from improving your credit score all the way to saving enough down payment. Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made.Īt the bottom of the calculator there is also an option to turn on displaying a monthly amortization schedule showing your loan payment progress month-by-month.īack Done Maximizing the Power of Extra Mortgage Paymentsīuying a house is one of the most expensive transactions people make. You could add 360 extra one-type payments or you could do an extra monthly payment of $50 for 2.5 years and then an extra monthly payment of $100 for 3 years, etc. If you would like to make multiple payments for ranges of time you can enter multiple one-time payments or other periodic payment types by clicking on the "Add Payment" link. For example you can add a one-time lump sum inheritance payment along with annual income tax rebate payments, annual holiday bonus payments and regular weekly, biweekly or monthly contributions. You can combine mutliple extra payment types in parallel. Recurring weekly and biweekly payments will be converted into their monthly equivalents and added to your regular monthly payment. By default recurring payments last the duration of the loan unless you select an earlier end date.

Recurring payments will be applied for the ranges you specify. One time payments will be applied on the date you specify. Then click on the calculate button to see your results. Then add any other additional payments you would like to make be it one-time, weekly, biweekly, monthly, quarterly or yearly. You can optionally add your other homeownership expenses in the middle section. Usage InstructionsĮnter your normal mortgage information at the top of this calculator.

If you are considering refinancing at today's low rates, current Los Angeles refinance rates are published below. An in-depth guide offering money saving tips appears below the calculator. Getting The Most Out of Using This CalculatorĮxpand the drop downs for usage tips and suggestions.

0 kommentar(er)

0 kommentar(er)